Understanding Insurance Options For Drug Abuse Therapy: An Overview

Understanding Insurance Options For Drug Abuse Therapy: An Overview

Blog Article

Post Created By-Hagan Holst

Imagine navigating insurance protection for Drug rehab as trying to assemble a complex puzzle. Each piece represents a different element of your plan, and the obstacle depends on aligning them flawlessly to make certain comprehensive insurance coverage.

Understanding the complexities of insurance policy can be difficult, but fear not, as we break down the necessary components that will certainly equip you to make educated choices and safeguard the assistance you require.

Understanding Insurance Insurance Coverage Essential is the primary step in your journey to taking full advantage of the benefits readily available to you.

Recognizing Insurance Coverage Insurance Coverage Fundamentals

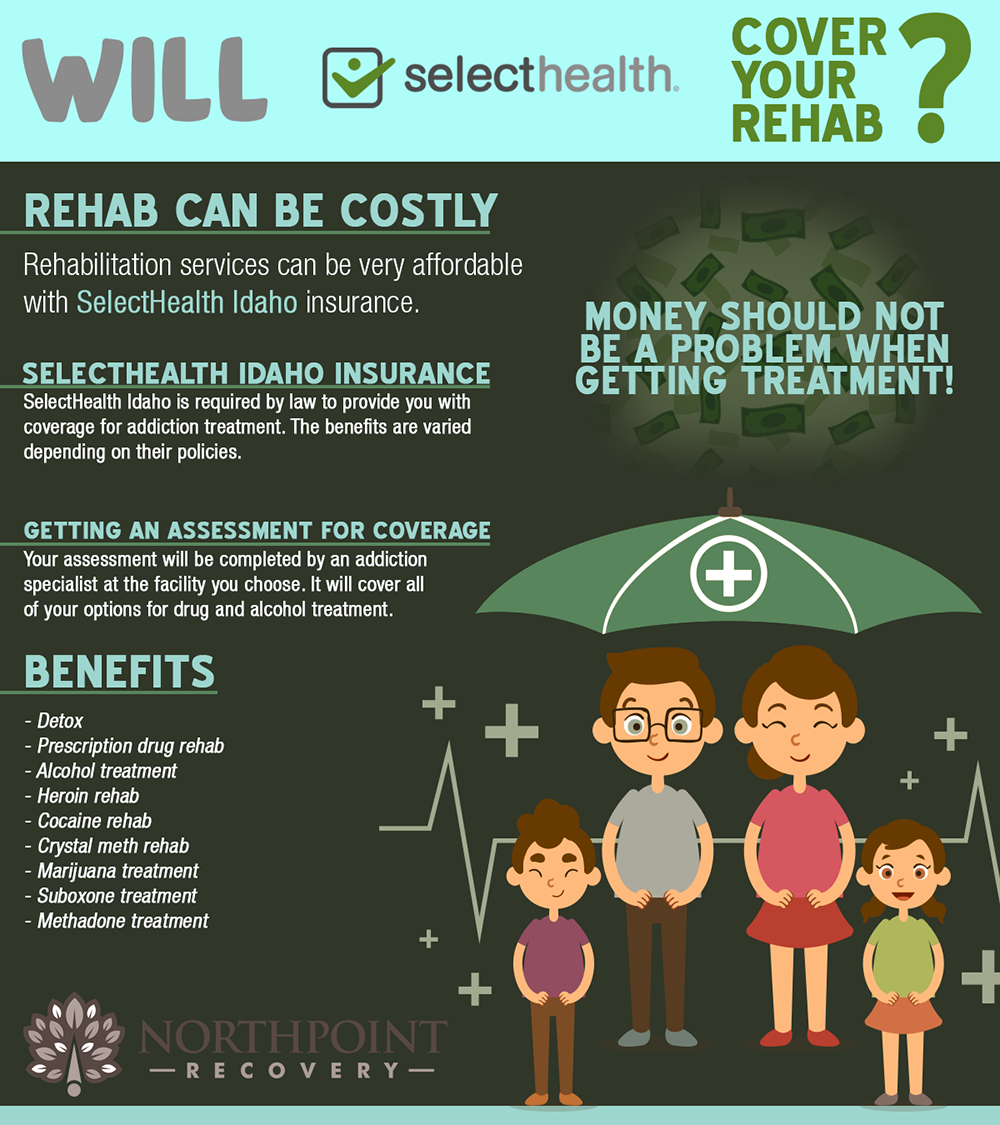

To realize the basics of insurance protection for Drug rehab, start by comprehending just how your policy features. Check into whether https://www.etonline.com/orlando-brown-fans-rally-around-him-after-learning-he-overcame-drug-addiction-173464 includes psychological wellness and drug abuse benefits. Check if there are any certain needs for coverage, such as pre-authorization or referrals.

Understanding your insurance deductible and copayment responsibilities is vital. Acquaint on your own with the terms of your plan, like in-network providers versus out-of-network carriers. Knowing the extent of protection your insurance policy provides for various types of therapy programs will aid you intend properly.

Keep track of any restrictions on the number of sessions or days covered to prevent unforeseen prices. Being aggressive in understanding your insurance policy can make a considerable difference in accessing the treatment you need.

Secret Elements for Protection Resolution

Recognizing vital aspects that figure out coverage for Drug rehabilitation under your insurance coverage is important for navigating the procedure properly.

The primary factors that influence protection include the kind of treatment center, the particular services supplied, the period of therapy, and whether the center is in-network or out-of-network.

In-network centers are commonly more inexpensive because they have actually negotiated rates with your insurance provider.

Additionally, https://anotepad.com/notes/i5eppmh9 may require pre-authorization for treatment or have specific criteria that must be met for coverage to be approved.

https://eliseo.technetbloggers.de/uncovering-hope-examining-the-advantages-of-a-center-for-dealing-with-addiction to evaluate your policy meticulously, recognize these vital variables, and communicate properly with your insurance provider to guarantee you maximize your protection for Drug rehab.

Tips for Maximizing Insurance Coverage Perks

To maximize your insurance policy advantages for Drug rehabilitation, it's important to be positive in checking out means to optimize coverage. Right here are some suggestions to assist you optimize your insurance benefits:

- ** Testimonial Your Policy **: Recognize what your insurance covers and any type of restrictions that may use.

- ** In-Network Providers **: Pick rehab centers and health care experts that are in-network to decrease out-of-pocket costs.

- ** Use Preauthorization **: Acquire preauthorization for therapy to make sure insurance coverage and protect against unforeseen costs.

- ** Charm Denials **: If an insurance claim is denied, do not hesitate to appeal the choice with extra information or support from your healthcare provider.

https://www.liveinternet.ru/users/olesen_knox/post503779500 as a compass overviews a ship with treacherous waters, understanding insurance coverage for Drug rehab can browse you in the direction of the right therapy path.

By understanding the basics, key factors, and tips for maximizing advantages, you can stay away from challenges and get to the safety of healing with self-confidence.

Let your insurance policy coverage be the assisting light that leads you in the direction of a brighter, healthier future.